ENVIROFORENSICS AND EHRENREICH & ASSOCIATES DISCUSS HOW ENVIRONMENTAL CONTAMINATION ISSUES CAN IMPACT THE PROCESS OF SELLING A DRY CLEANING BUSINESS, AND HOW DRY CLEANERS CAN BEST PREPARE FOR THE TRANSACTION.

BY: JEFF CARNAHAN & RICHARD EHRENREICH

We’ve talked several times in this featured column about what triggers an environmental cleanup, and you likely know by now that buying or selling a property or business is the most common catalyst for environmental cleanups. While businesses are put on the market routinely, there are several factors at play today that have resulted in higher than normal transaction activity amongst dry cleaners.

THE DRY CLEANING MARKET DOWNTURN

A downturn in the dry cleaning market has been brewing for a couple of decades, but the biggest hit began during the 2008 recession created by the housing lending market. Unemployment rose and many service businesses, dry cleaners included, were heavily impacted by a tightening of discretionary spending by consumers. Profit margins were reduced across the industry as customer spending decreased, and many smaller operators were not able to weather the storm. To make matters worse, the environmental concerns related to the use of many dry cleaning solvents, mainly perchloroethene (Perc), were on the rise. Dry cleaners started being pressured by property owners, regulatory agencies, and consumers to switch to less problematic solvents. This is not as easily said than done since making the switch means buying expensive equipment, which can compound the burden of already depressed profits. Some dry cleaning business owners who had been prosperous during previous decades and who were nearing retirement age took the clue that it was time to sell and retire. Others just couldn’t make the numbers work anymore and started looking for larger operators to sell their business to without much hassle.

Now that the national economy has been in slow recovery for around ten years, rent is on the rise. For those dry cleaning operators who don’t own their property and are still waiting for business to pick back up, this further compounds the problem. Property investors are renovating and improving many retail centers to substantiate the higher rents, and some dry cleaners are losing their leases unless they make a solvent change away from Perc. Retail property owners want to be associated with “green” dry cleaners only.

In addition, business fashions have become more casual and hasn’t required as much dry cleaning, thereby removing the potential relief from the recovery of discretionary spending habits alongside the lower unemployment rate. While the industry is already adapting to meet the changing wants and desires of their customers, many smaller and long-term family dry cleaning businesses find themselves between a rock and a hard place.

FACTORING IN THE POTENTIAL FOR ENVIRONMENTAL CONTAMINATION

Whether you are considering a sale of your dry cleaning business or considering a purchase of a dry cleaner whose owner may be implementing an exit from the business, the fear of possible environmental contamination will need to be addressed during the process.

Selling or buying a dry cleaning business is no different than the mergers or acquisitions that you may read about involving much larger companies. When one business buys another, there are assets and liabilities that must be transferred, held, or dispersed. Buyers will want to pay a fair market rate for the positive assets of a company and try to avoid taking the liabilities as part of the deal. Liabilities typically carry with them a negative monetary value and serve to lower the purchase price.

Environmental contamination issues are always on the liabilities list. From the seller’s perspective, they want to be able to get the full value for business and be able to walk away from the liability as well. Many dry cleaner deals fall through when the negative value of the environmental liability offsets the positive value of the business assets to the extent that the sale price is no longer motivating to the seller.

In order to save the deal, the environmental liabilities can be separated from the sale such that the buyer only purchases the assets of the dry cleaner at fair market value under a new corporate entity and the seller retains the environmental liability. This allows the deal to go through and maximizes the value of the sale, but the seller is left holding a bag of liability with a huge potential negative price tag. Keep in mind this is not Plan A and will not provide you the most value.

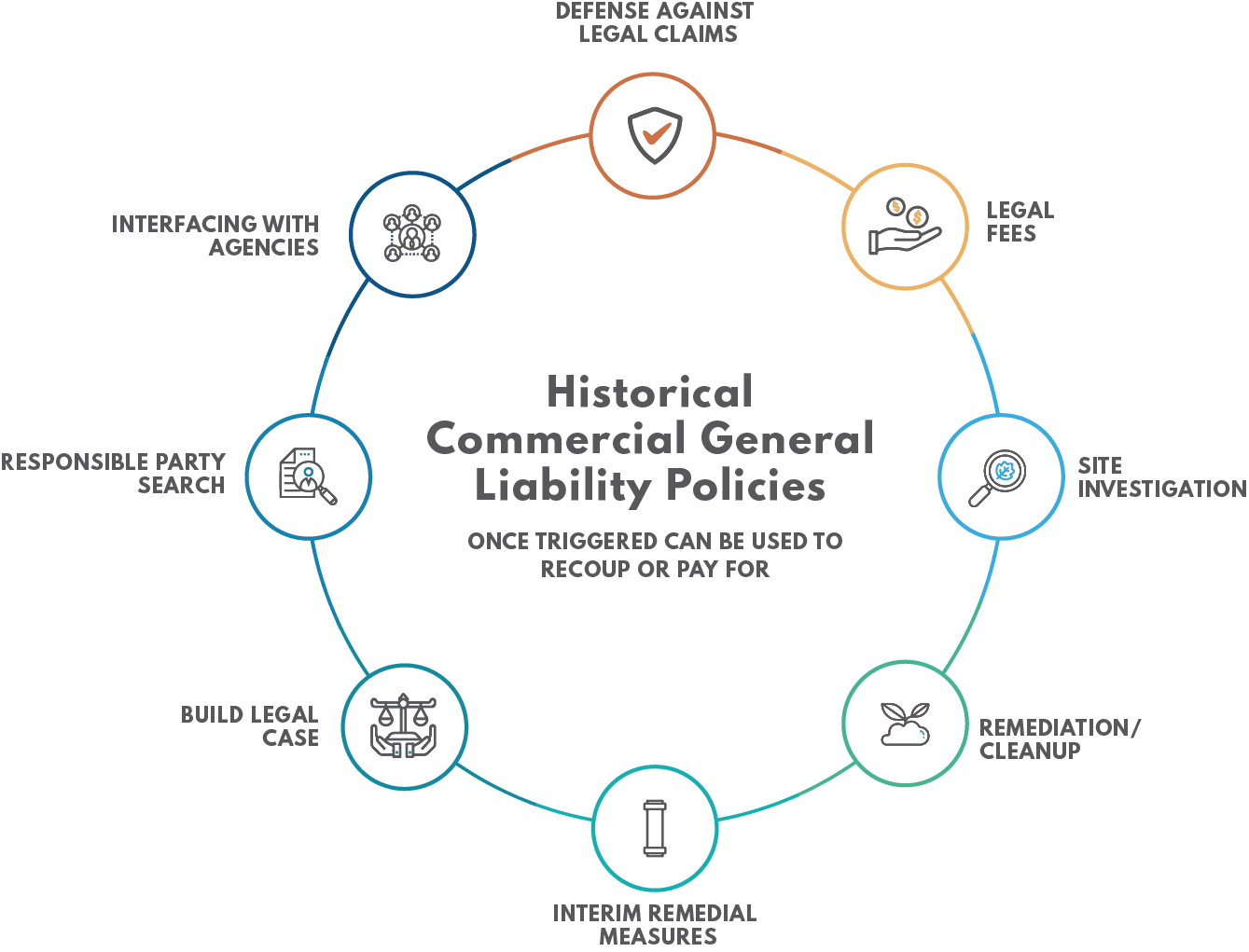

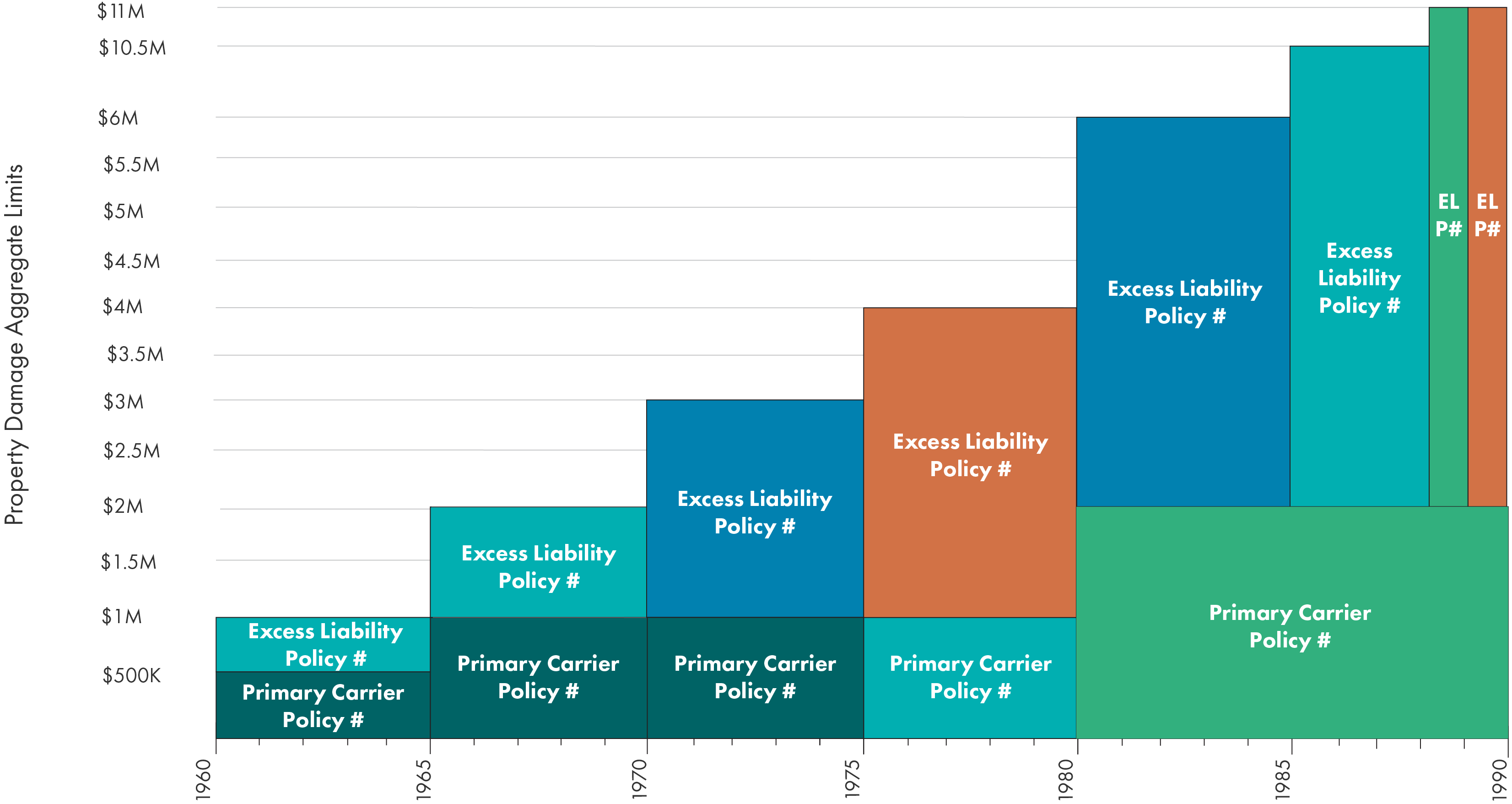

The fact that a dry cleaner’s old commercial general liability (CGL) insurance policies are viable positive assets to the business often goes without consideration. If a business is sold leaving the corporate entity intact, those old policies will transfer as well, thereby offsetting the negative value of the environmental liabilities. Similarly, if a business is sold as an asset-only acquisition into a new corporate entity, the old CGL policies will remain with the policyholder who retains the environmental liability. The fact that your historical CGL policies can play so monumentally into this process is a testament to finding and utilizing them.

THE THREE STEPS TO SELLING YOUR BUSINESS

There is some good news out there for dry cleaners and the garment and textile market as the industry changes and adapts to meet the changing needs of their customers. Some operators are even looking to take advantage of shrinking competition and double-down on a consolidation strategy. If you are looking to sell your business within the next couple of years, take the time to do some planning so that you can maximize your returns and avoid surprises that could kill a deal to sell your business. It’s a buyer’s market right now, so give yourself a fighting chance.

1. ASSEMBLE A TEAM THAT WILL WORK TOGETHER EFFECTIVELY TO PROVIDE YOU WITH THE EXPERIENCE AND SPECIFIC KNOWLEDGE YOU NEED TO MAKE SURE NOTHING GETS MISSED. YOUR TEAM SHOULD CONSIST OF THE FOLLOWING SEASONED ADVISORS WHO ARE FULLY AWARE OF YOUR STATE’S REQUIREMENTS, AS NEEDED:

- A Business Broker and maybe a Commercial Real Estate Agent – Find a business broker that knows the dry cleaning industry. A good business broker is not just going to list your business for sale, and then collect their commission. A good business broker will spend a significant time with you to help you understand what will be attractive or repulsive to potential buyers. It’s important to understand the playing field because it’s a huge part of the process.

- A Business Attorney – You’ll want a business attorney by your side because there will be numerous rules and laws that need to be closely adhered to during the sales process. The last thing you want to do is break the law by accident.

- A CPA and maybe a Tax Attorney – You’ll need to understand the tax implications of gains realized from the sale and having a CPA and Tax Attorney can be there to explain these implications.

- A Commercial SBA Banker – Chances are there will be some lending involved on the buy-side, and you’ll need to manage net proceeds from the sale on your side.

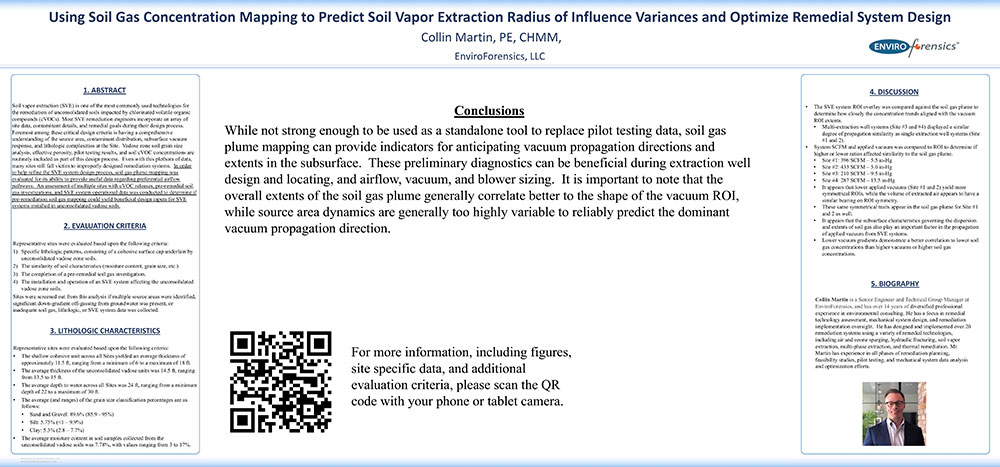

- An Environmental Consultant – Since dry cleaners are historically known for environmental contamination, you’ll want to have an environmental consultant with chlorinated solvents experience by your side to help fulfill your investigation and/or cleanup requirements.

- An Insurance Archeologist – You’ll want to gather all of your valuable assets as you’re preparing for this process and your old CGL insurance policies should be part of your list for asset protection.

2. DO A BUSINESS EVALUATION TO UNDERSTAND THE GOOD, THE BAD AND THE UGLY BY TAKING INVENTORY OF THE COMPANY’S ASSETS AND LIABILITIES. HERE ARE A FEW QUESTIONS TO HELP YOU GET STARTED.

- What is your debt?

- What asset contracts do you have that would transfer with the business?

- What is your discretionary cash flow?

- What environmental liability might you, or do you, have?

- What historical insurance assets may be accessible to offset latent liabilities?

3. DEVELOP WHAT YOUR OBJECTIVES FOR THE SALE BY ANSWERING THE FOLLOWING QUESTIONS.

- How much money do you need to clear from the sale?

- What are the upfront costs of the transaction?

- Do you want any residual corporate entities to manage liabilities and assets?

By taking these steps before you’re actively ready to sell your dry cleaning business, you’ll be prepared with the information you’ll need to move forward. You’ll also have the right team by your side to help you achieve your goal of selling your business for the best price. Don’t let environmental contamination stall your plans to sell your dry cleaning business.

If you are currently going through this process or you are planning on selling your business soon, contact EnviroForensics President, Jeff Carnahan at jcarnahan@enviroforensics.com or Managing Member and Principle Consultant/ Broker of Ehrenreich & Associates, LLC, Richard Ehrenreich at richard@ehrenassoc.com as resources. We’d be more than happy to have a conversation with you about transaction preparation and environmental contamination.

As seen in Cleaner & Launderer

Jeff Carnahan, President at EnviroForensics

Jeff Carnahan, President at EnviroForensics

Jeff Carnahan, LPG, has 20+ years of environmental consulting and remediation experience. His technical expertise focuses on the investigation and interpretation of subsurface releases of hazardous substances for the purpose of evaluating and controlling the risk and cost implications. He has focused on being a partner with the dry cleaning industry for the past decade, and he’s a frequent contributor to the national dry cleaning publication Cleaner & Launderer. He is an industry leader in understanding that environmental risk includes not only cleanup costs, but also known and unknown third-party liability.

Richard F. Ehrenreich, F- CBI, CED, SBA is the Managing Member and Principle Consultant/Broker with Ehrenreich & Associates, LLC. Richard is a recognize national expert in the Exit Strategy and Sale of Privates Owned Businesses. Richard has served in leadership roles for multiple dry cleaning associations. He is the third generation of family businesses that serve the Dry cleaning Industry for over 60 years. Over the past 15-years, Richard has completed over 800-unit evaluations, plus various legal and financial issues.

Richard F. Ehrenreich, F- CBI, CED, SBA is the Managing Member and Principle Consultant/Broker with Ehrenreich & Associates, LLC. Richard is a recognize national expert in the Exit Strategy and Sale of Privates Owned Businesses. Richard has served in leadership roles for multiple dry cleaning associations. He is the third generation of family businesses that serve the Dry cleaning Industry for over 60 years. Over the past 15-years, Richard has completed over 800-unit evaluations, plus various legal and financial issues.

Morgan Saltsgiver, LPG, Director of Brownfields and AgriBusiness

Morgan Saltsgiver, LPG, Director of Brownfields and AgriBusiness Joe Miller, Account Executive

Joe Miller, Account Executive

Jeff Carnahan, President at EnviroForensics

Jeff Carnahan, President at EnviroForensics Richard F. Ehrenreich, F- CBI, CED, SBA is the Managing Member and Principle Consultant/Broker with Ehrenreich & Associates, LLC. Richard is a recognize national expert in the Exit Strategy and Sale of Privates Owned Businesses. Richard has served in leadership roles for multiple dry cleaning associations. He is the third generation of family businesses that serve the Dry cleaning Industry for over 60 years. Over the past 15-years, Richard has completed over 800-unit evaluations, plus various legal and financial issues.

Richard F. Ehrenreich, F- CBI, CED, SBA is the Managing Member and Principle Consultant/Broker with Ehrenreich & Associates, LLC. Richard is a recognize national expert in the Exit Strategy and Sale of Privates Owned Businesses. Richard has served in leadership roles for multiple dry cleaning associations. He is the third generation of family businesses that serve the Dry cleaning Industry for over 60 years. Over the past 15-years, Richard has completed over 800-unit evaluations, plus various legal and financial issues.

Collin Martin, PE, CHMM

Collin Martin, PE, CHMM

Joe Miller, Account Executive

Joe Miller, Account Executive

Dru Shields, MWDLI Advisory Board Member & Director of Accounts at EnviroForensics

Dru Shields, MWDLI Advisory Board Member & Director of Accounts at EnviroForensics