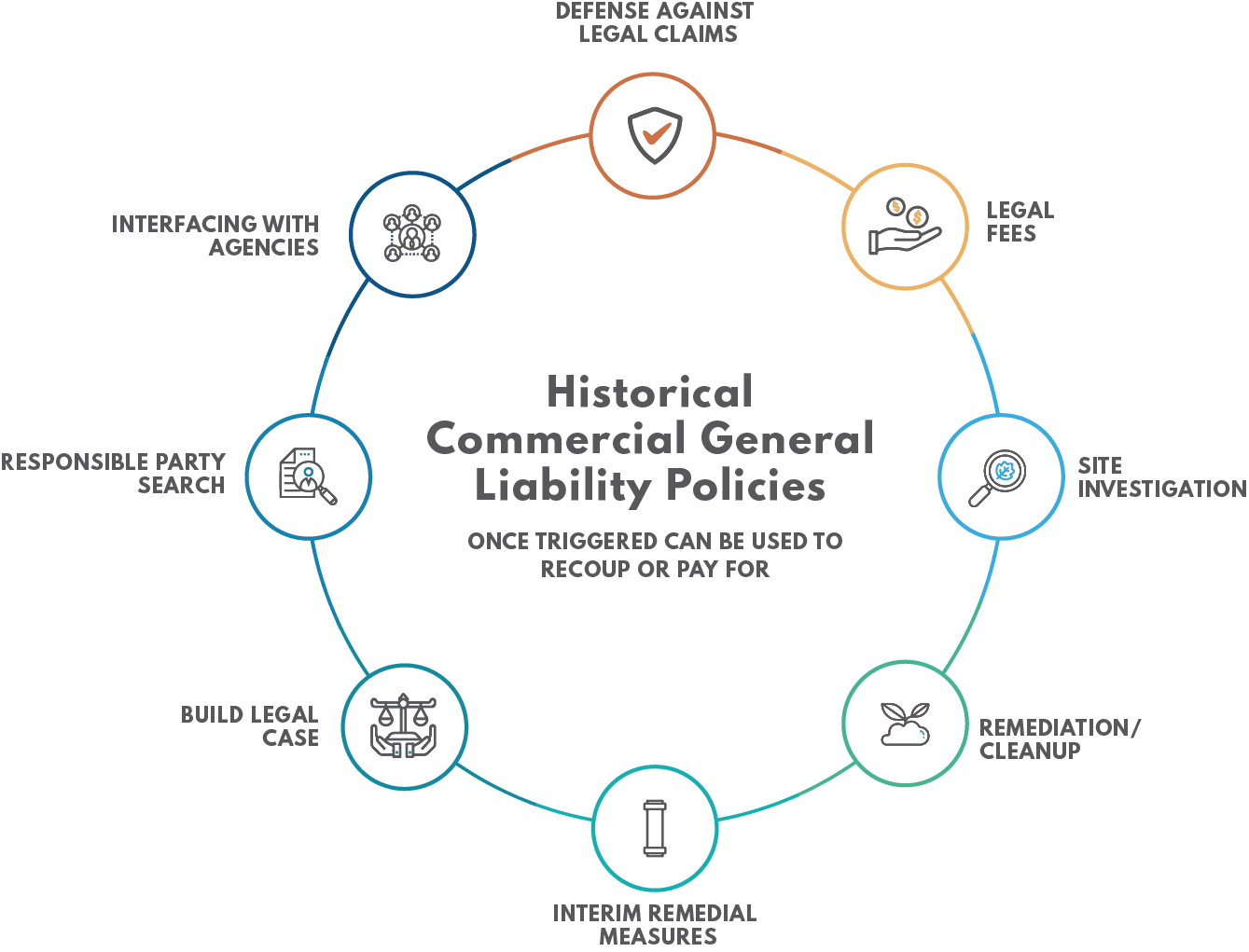

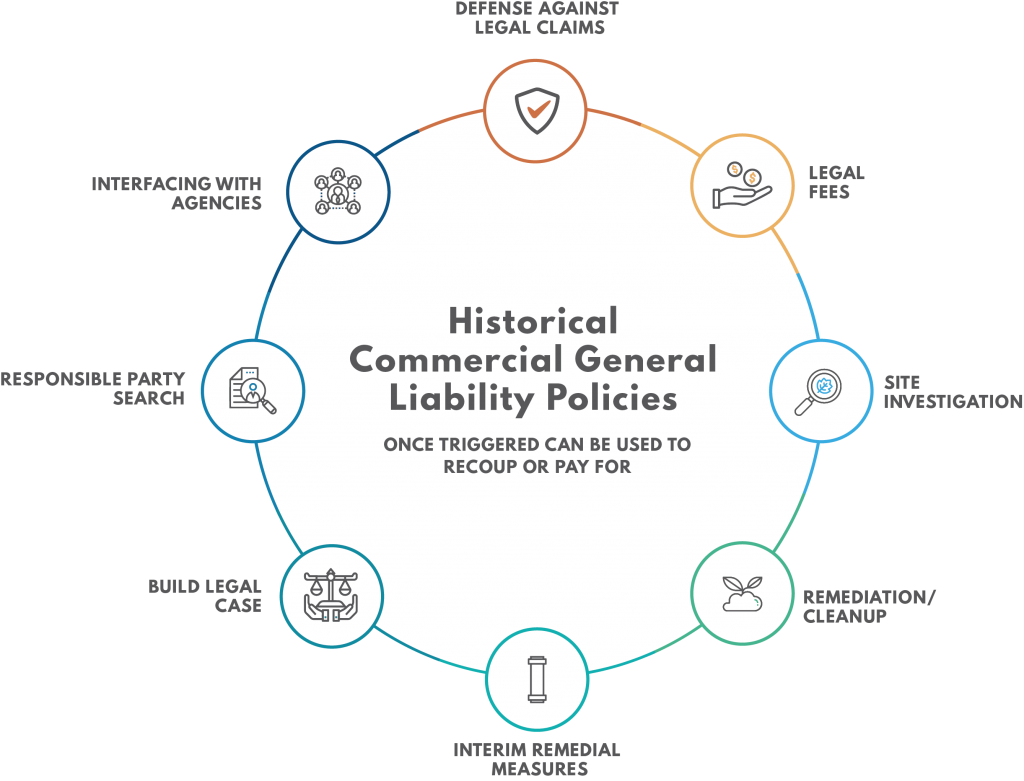

The process of finding a client’s old insurance policies, tendering claims, and utilizing those available funds to clean up environmental contamination is a complex one. EnviroForensics’ President, Jeff Carnahan, LPG, and Director of Accounts, Dru Shields have extensive experience successfully guiding dry cleaners through the process. At the end of a recent webinar, we had a Q&A session full of interesting and frequently asked questions. Here are the responses.

This Q&A session has been lightly edited for clarity.

1: What if the insurance company is no longer in business?

Jeff Carnahan: We do actually see that periodically. We hope that that’s not your only insurer historically, but if it is, we have seen situations where now a defunct insurance carrier sets up some roll-off funds in order to provide certain amounts of dollars on the coverage. It’s not a great situation, to be honest, but in that type of a scenario, we would want to look at some other potential funding options. You might be in a state where there’s a dry cleaner trust fund, but there are also some other potential funds available. Maybe by working with your local municipality, there can be some low-interest loans available, and some other financial resources that might be able to help out.

2: What could I do if a delivery company that spilled the PERC was part of the contamination and that company is no longer in business?

Carnahan: So, there are a few different parts to this answer. First of all, let’s just say that there was another party responsible for part of the contamination. Let’s start there. So, one of the things we do during the investigation phase — or typically during the defense stage — is we try to evaluate all the potential sources of contamination. And, if we identify, or if there’s actual proof or anecdotal evidence of another source, we typically will start to use the science and use the analytical data to allocate responsibility for the contamination in the ground. If, let’s say, the trucking company was not defunct, you would file a claim. We would work with your carrier and they would likely file a claim directly against that transportation company’s, or they would put a claim in on their own insurance company. Whenever that company is out of business, I like to say that there’s a difference between “dead” and “dead and buried.” So, if a company is out of business, there are still avenues of access to their old policies, and we can work with counsel to actually file a claim against that company who is now no longer viable against their insurance companies, presuming that they’re viable.

3: How do you make claims when the insured has no records of coverage but recalls the specific insurance companies he bought policies from?

Dru Shields: That is the whole purpose of hiring an insurance archeologist. It’s very difficult to go to the insurance carrier and say, “I know that you covered me. Will you please provide a defense?” That’s why you need to be able to show proof that a policy existed for the insured. Even if you don’t have old business records, there are efforts that insurance archeologists can implement as far as locating proof of policies, but you will need to be able to have that proof; some sort of evidence to show that you were insured by a specific insurance carrier to require them to defend.

4: I completed a cleanup and it was at great expense. Who can I talk to look into historic insurance?

Shields: You would need to be able to locate and prove that there were policies in place that would defend. Again, it kind of also depends on state case law as far as how those insurance policies would apply. You may not be able to recoup all costs of what you’ve spent on a cleanup, but you’d be able to recover some of those costs.

Carnahan: I think that falls into the category of a “cost recovery claim”, and we’ve certainly helped clients do that as Dru mentioned. There’s no guarantee that we will recover 100% of what they spent but a good chunk can be available.

5: On average, how long does it take to look for old insurance policies?

Shields: We typically allow 90 business days for our insurance archeologists to complete a search for insurance policies. There are rush options available, too.

6: Is there any liability on behalf of sewer districts? A lot of contamination comes from the fact that sewers were designed to leak.

Carnahan: I just saw a couple of days ago that, in California, there was a suit decided saying that the municipality did have some responsibility. It’s going to have to be proven up pretty significantly, but it can certainly be done. From the dry cleaner’s perspective, sewer releases are very common. I’ve seen situations where there’s been no release on the property itself. The cleaner had no idea there was a problem until sewer work was done about a quarter of a mile downstream, and they found a release and actually went back and pointed the finger at the dry cleaner. Those are the types of situations where we recommend partnering with a good defense attorney; that’s where that strategy is going to come from. We work very closely with defense counsel to help devise litigation and a scientific strategy that’s going to help prove your case. And then, we’ll just go after other potentially responsible parties.

7: Do you work on an hourly or contingency fee basis?

Carnahan: It’s more common for us to work on an hourly basis. We do time and materials invoices, and we provide our invoices directly to the carriers. And, our invoices are extremely detailed. They look like a law firm’s invoices if you’ve seen those before, which I’m sure most of you have as business owners. So, it’s time and materials. We provide that to the insurance carriers, and then we take the initiative on making sure that it gets paid, and we do the arguments. Now there are some situations like the cost recovery case that was brought up a little earlier, that we could potentially do on a contingency basis. Also, I’ve had dry cleaner clients who had multiple sites (multiple stores) and after having a problem, they want to cash in their old CGL policies. That’s also a possibility. We have done that for dry cleaner clients and we can also do that on a contingency.

Shields: We also do insurance archeology on a time and materials basis. That one, we don’t typically do on contingency, but it would be something we could talk about on a one-on-one basis.

8: What is the average cost of a Phase I and a Phase II?

Carnahan: Phase I Environmental Site Assessment are required by lenders before they will loan on property sale or use the property as collateral when lending. Phase 1’s are also required in order to obtain Bone Fide Prospective Purchaser (BFPP) status when purchasing a contaminated property. The requirements for conducting a Phase 1 has increased over the years, however, the cost has remained relatively constant. The true price of a Phase 1 is about $4,500, but because they are considered a commodity by banks and small consulting firms and one-person shops compete for this work, the prices can be as low as $2,500. There is a lot of liability in the Phase 1 ESA investigation and reporting, so going cheap may not be the best decision in the long run.

Phase II’s, on the other hand, are designed to give an understanding as to whether or not soil and groundwater have been impacted at the subject property. A Phase II may give the consultant an understanding as to the magnitude of an environmental problem, but it will not necessarily be the final investigative work required to determine the extent of a problem. A Phase II can be in the range of, say $15,000 to $30,000. It could be even less if everything looks clean on the Phase I –except for the fact that there is, in fact, a dry cleaner involved. As many of you may know, the current standard established for conducting Phase I’s says that if it is a dry cleaner site or it is adjacent to a dry cleaner, there must be Phase II sampling.

9: How does a dry cleaning business owner start the insurance archeology and environmental cleanup process if there hasn’t been a lawsuit or a sale to trigger a defense?

Carnahan: If you don’t have a lawsuit or a sale to worry about, it’s the perfect time to start pulling things together. Have a quick look at your business records and see what you can pull together. Give Dru a call at 866-888-7911 to start talking about some insurance archeology services. And, if you are planning on selling off the property, but keeping the stock of the company, that means you’ll retain the insurance policies, and that’s a good thing.

10: Who makes the final determination that a site has been sufficiently cleaned up?

Carnahan: At first blush, the regulatory agency makes that decision. Again, the cleanup standards are typically based on human health exposure criteria, and that’s what they use to establish the cleanup objectives. So, once the state regulatory agency is comfortable that you’ve reduced contamination at the site to concentrations that are deemed to be safe to human health and the environment, they can provide you a closure.

The second part of the answer is that the property owner has the right to determine what that land use is going to be. There are different sets of cleanup standards for commercial land use or industrial land use, residential land use, and even recreational land use. Typically, if the owner of the property has plans of future residential usage, there will be stricter cleanup objectives that need to be met. The standards are a little less strict if the property is going to be used for commercial purposes. So, it’s sort of a hybrid answer in that the regulatory agencies will have final say based on the land use that’s established by the property owner.

11: If I purchase my dry cleaning shop after 1986, and an environmental issue pops up, is there still a way to utilize the policies of past owners of the same business/properties?

Shields: Yes, you can, and as I mentioned before when I was discussing insurance and through the process of insurance archeology, we are looking for policy information for any potentially responsible party. So, any of that past ownership we would be looking to find policies for those entities. In that instance, typically what you will need to do is hire legal counsel to help pursue responsible parties for those insurance policies to kick in and pay for any investigation and remediation.

Carnahan: Most of the time those can be very friendly arrangements. Those don’t have to be litigious situations. They can be, but they don’t have to be.

Shields: And even if those entities are deceased or bankrupt, they are still usable at that point, too.

12: Will PERC naturally degrade over time if nothing is done?

Carnahan: No. Perc is actually considered a recalcitrant compound, and what that means is that under normal conditions, perc will not break down naturally. The twist is that “normal conditions” assumes that the aquifer and/or the subsurface has oxygen available, and in an oxygen rich environment, perc does not break down. One of the things we do whenever we inject chemicals is to try to create an oxygen-depleted environment, so certain types of microbes can flourish, which will then break down the PERC. If it’s a mere surface release in the absence of anything creating an oxygen-depleted environment, the stuff just hangs around. We deal with a lot of dry cleaner sites where releases occurred fifty or sixty years ago, and other than being bigger and more spread out, the perc just hasn’t broken down at all.

13: What if contamination is found on my property, but money is not available for me to clean it up? Can I be shut down?

Carnahan: The regulatory agency can demand a cleanup, but the first thing they’re going to do is determine if there are any potentially exposed parties. In other words, if someone next door has a vapor intrusion problem caused by the contamination at your site. You might not necessarily – right out of the gate – be looking at millions of dollars here, but you could easily be looking at tens of thousands of dollars to make sure that no one is being exposed as time goes on. It’s not a perfect situation, but like I said before, we should at least look into other potential funding sources available that could help out.

Do you have questions? Contact us

Jeff Carnahan, LPG, has 20+ years of environmental consulting and remediation experience. His technical expertise focuses on the investigation and interpretation of subsurface releases of hazardous substances for the purpose of evaluating and controlling the risk and cost implications. He has focused on being a partner with the dry cleaning industry for the past decade, and he’s a frequent contributor to the national dry cleaning publication Cleaner & Launderer. He is an industry leader in understanding that environmental risk includes not only cleanup costs, but also known and unknown third-party liability.

Jeff Carnahan, LPG, has 20+ years of environmental consulting and remediation experience. His technical expertise focuses on the investigation and interpretation of subsurface releases of hazardous substances for the purpose of evaluating and controlling the risk and cost implications. He has focused on being a partner with the dry cleaning industry for the past decade, and he’s a frequent contributor to the national dry cleaning publication Cleaner & Launderer. He is an industry leader in understanding that environmental risk includes not only cleanup costs, but also known and unknown third-party liability.

Dru Shields has over 10 years of account management experience in the environmental consulting and engineering industry. She manages a team of account executives who work across the country. Shields is a member of numerous regional dry cleaning associations in addition to serving on the board of the Midwest Drycleaning and Laundry Institute (MWDLI). Shields has extensive experience in assisting clients in securing funding for their projects through historical insurance policies. As Director of Accounts, Shields helps business and property owners facing regulatory action to navigate and manage their liability.

Dru Shields has over 10 years of account management experience in the environmental consulting and engineering industry. She manages a team of account executives who work across the country. Shields is a member of numerous regional dry cleaning associations in addition to serving on the board of the Midwest Drycleaning and Laundry Institute (MWDLI). Shields has extensive experience in assisting clients in securing funding for their projects through historical insurance policies. As Director of Accounts, Shields helps business and property owners facing regulatory action to navigate and manage their liability.

Kristen Brown brings more than a decade of research and managerial experience in broadcast journalism to the field of insurance archeology. Since joining the PolicyFind team in 2015, Ms. Brown has successfully documented liability insurance programs on behalf of municipalities, manufacturers and dry cleaners. She continues to translate her expertise in source procurement and digital fact-finding, performing insurance research activities at a very high level, providing on-time execution of contracted performance goals.

Kristen Brown brings more than a decade of research and managerial experience in broadcast journalism to the field of insurance archeology. Since joining the PolicyFind team in 2015, Ms. Brown has successfully documented liability insurance programs on behalf of municipalities, manufacturers and dry cleaners. She continues to translate her expertise in source procurement and digital fact-finding, performing insurance research activities at a very high level, providing on-time execution of contracted performance goals.

Take the pledge to reduce pollution

Take the pledge to reduce pollution

Jeff Carnahan

Jeff Carnahan Dru Shields

Dru Shields

Alan Turing, Biologist

Alan Turing, Biologist  Julia Serano, Biologist

Julia Serano, Biologist

2. Willard Carpenter House

2. Willard Carpenter House 3. Pearl Laundry

3. Pearl Laundry

6. Indianapolis Central Library

6. Indianapolis Central Library  7. Hirschman-Bryan House

7. Hirschman-Bryan House 8. Indiana University Auditorium

8. Indiana University Auditorium 9. Soldiers’ and Sailors’ Monument

9. Soldiers’ and Sailors’ Monument 10. Gary Aquatorium

10. Gary Aquatorium