Banks & Lenders

Potential environmental issues on collateral property represent one of the largest risk exposures to a commercial lender. Environmental risks can happen whenever a lender finances a new purchase, refinances an existing loan, or assumes a loan previously carried by another financial institution. In case of a loan default, lenders must assess their environmental risk to avoiding inheriting costly environmental problems.

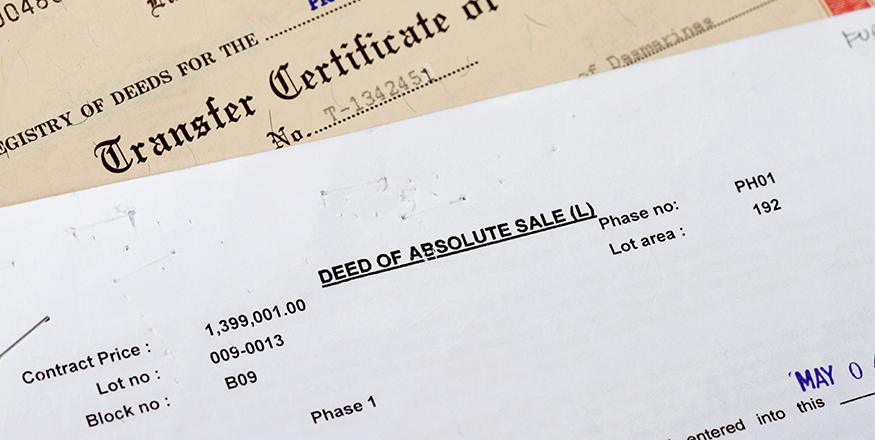

WE CONDUCT PHASE I AND PHASE II ENVIRONMENTAL SITE ASSESSMENTS

We help estimate the extent of possible exposure liability by conducting real estate due diligence, including Phase I and Phase II Environmental Site Assessments, to determine if businesses or properties carry any potential environmental liabilities. We also ensure that our assessments are complete and correct, which afford the borrower environmental liability protection, which in turn, benefits the bank. If a financial institution holds contaminated properties, we can conduct insurance archeology to locate historical insurance policies that can be used as assets to fund the environmental cleanup and legal costs. We help banks and lenders competitively manage risk and make sound underwriting decisions.

We trust EnviroForensics to conduct the necessary due diligence to protect our borrower and ourselves from environmental liability during property transactions, refinancing and construction loans where properties are being used as assets.